Pódcasts que no escucharás en ningún otro lugar, además de miles de audiolibros

Después de 7 días, $99 / mes.Cancela cuando quieras.

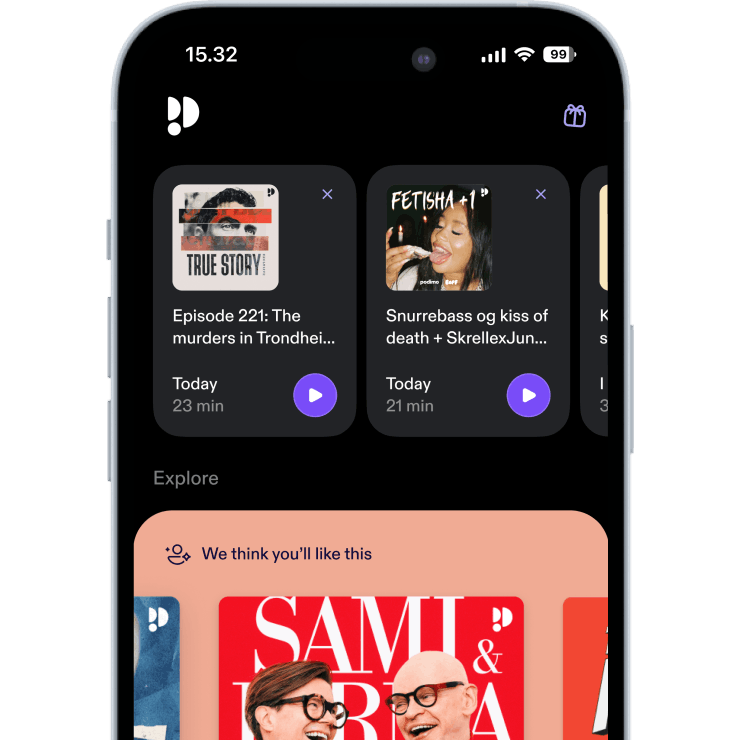

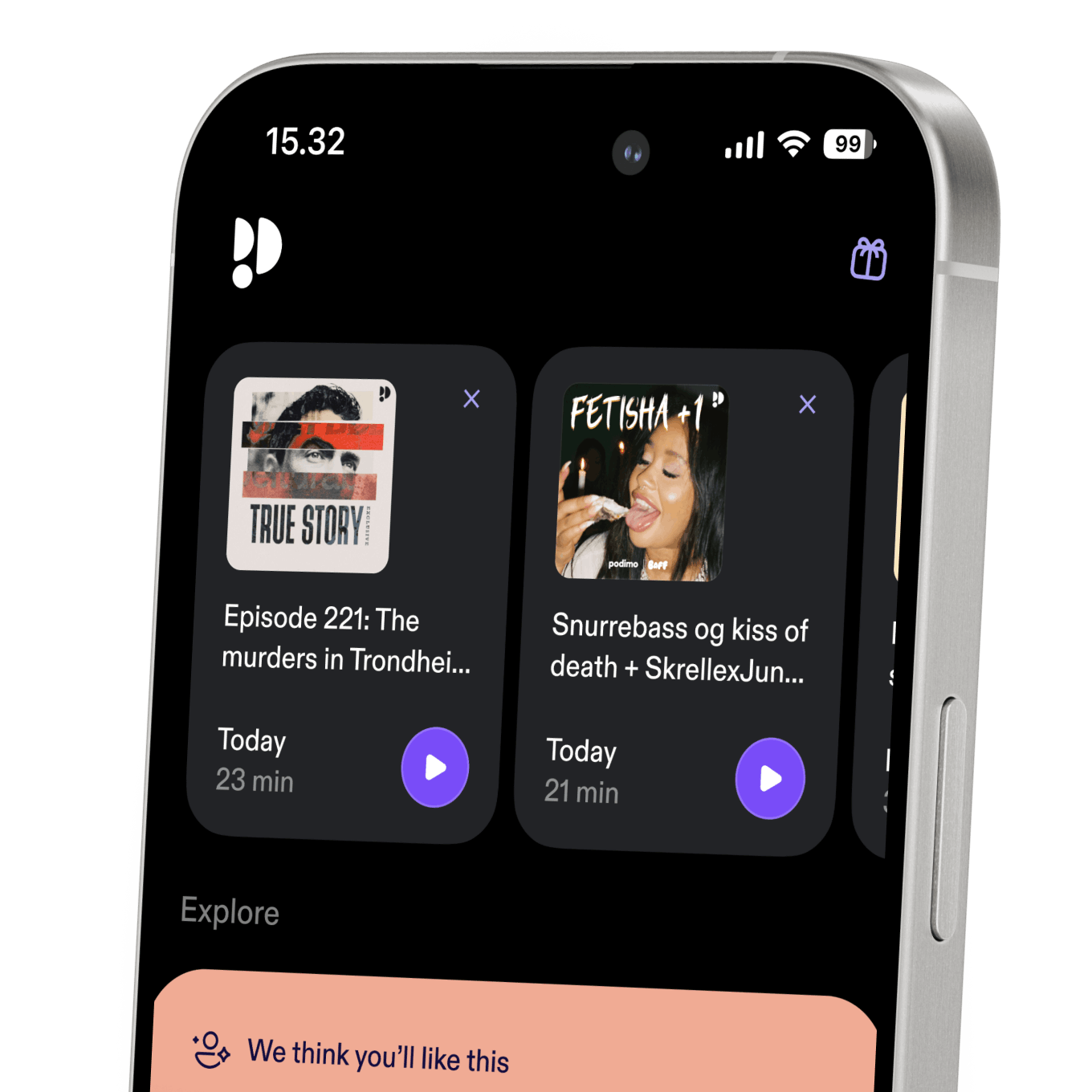

Llena cada momento con tus voces favoritas

Nuestra selección de podcasts exclusivos tiene todo lo que necesitas para mejorar tu día

Podcasts ilimitados

20 horas de audiolibros

Audiolibros recomendados

Descubre nuestra selección de bestsellers y libros imprescindibles

Más de 1 millón de oyentes

Podimo te va a encantar, y no estás solo/a

Pruébalo 7 días gratis durante

Después de 7 días, $99 / mes.Cancela cuando quieras.