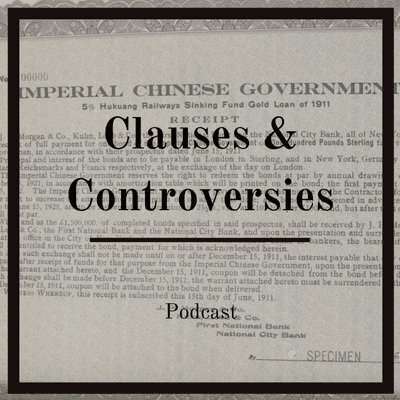

Clauses & Controversies

Podcast de Mitu Gulati & Mark Weidemaier

Empieza 7 días de prueba

$99 / mes después de la prueba.Cancela cuando quieras.

Más de 1 millón de oyentes

Podimo te va a encantar, y no estás solo/a

Rated 4.7 in the App Store

Acerca de Clauses & Controversies

Clauses and Controversies: A Podcast about International Finance, Contract Clauses and the Controversies Surrounding These Clauses

Todos los episodios

160 episodiosUkraine's Expansive "Fiscal Laws" Clause International sovereign bonds, and particularly those issued under English law, often include a clause providing that payments are subject to the applicable "fiscal and other laws." Usually, the clause makes clear this refers to fiscal laws in the “place of payment” (e.g., Luxembourg). Separately, international bonds also provide that, if the issuer imposes any taxes on bond payments, it must "gross up" payments to foreign investors, so the tax does not reduce their payments. Together, the two clauses usually immunize foreign investors from taxes imposed by the issuer but leave room for taxes imposed by the place of payment. Ukraine's bonds are different. They seem to leave room for Ukraine to impose its own "fiscal" law on payments. Arguably, they leave investors subject even to local laws that aren't fiscal in nature. Might this be a source of leverage for the country in its negotiations with GDP warrant holders, who have so far refused to make concessions in restructuring talks? Producer: Leanna Doty

The Greek GDP Warrant Drama Greece’s debt situation has improved remarkably, from default status in 2012 to investment grade in 2025. A few weeks ago though, Bloomberg reported on a brewing drama with the GDP warrants that were offered to investors in the brutal 2012 restructuring. Apparently, Greece has elected to exercise its right to call the warrants, and holders are yelling bloody murder at the low price at which Greece says it is entitled to buy. Every side has lawyered up and claims the other side is acting unreasonably. We speculate wildly on what might actually be going on and what is likely to happen. Producer: Leanna Doty

Some Questions, Now That it's About 3 Years Since Russia’s Default It has now been around 3 years since Russia’s invasion of Ukraine, which prompted EU and US sanctions and a default on Russia’s external bonds. The prescription clause in these bonds says that Russia’s obligations become void unless investors make claims within three years of the date payment is due. What does it mean to “make” a “claim”? Filing a lawsuit would do the trick. What about an email requesting payment? An automated message, which the depository sends out every payment date? Should bondholders have sought an agreement tolling the prescription period? Since they didn't, does Russia now have what amounts to an option to pay past due amounts? And what about interest on unpaid amounts? Does Russia owe interest on payments that were impossible to make due to sanctions? Producer: Leanna Doty

Sovereign Debt Odd & Ends An odds and ends podcast about unrelated sovereign debt topics. First up, Venezuela. Most investors have been sitting around waiting for an eventual restructuring and lifting of US sanctions. But a handful of funds sued early, got judgments, and have spent years trying unsuccessfully to collect. If they had succeeded, they would have recovered much more than similarly-situated creditors who waited around for a restructuring deal. But they failed and, in a bizarre twist, have asked the court to vacate their judgments, effectively returning them to the creditor queue. We cry foul. Next up, another fiscally-irresponsible and increasingly author ... well, it's the United States. We discuss the crazy (and terrifying) idea that the US might unilaterally extend the maturities of government debt. Producer: Leanna Doty

Is There Any Law of State Succession? Syria, Ukraine and Greenland. The law of state succession to obligations comes mostly from a different era, when war and conquest were legal and borders changed with some frequency. Today, we are faced with multiple situations where borders might change due to war. Does the law tell us what happens to the debts attributable to the acquired territory? And how do we translate legal rules that evolved in the 18th and 19th centuries into the modern era? Paul Stephan (Virginia), one of the foremost international law experts, joins us to discuss. Producer: Leanna Doty

Rated 4.7 in the App Store

Empieza 7 días de prueba

$99 / mes después de la prueba.Cancela cuando quieras.

Podcasts exclusivos

Sin anuncios

Podcast gratuitos

Audiolibros

20 horas / mes