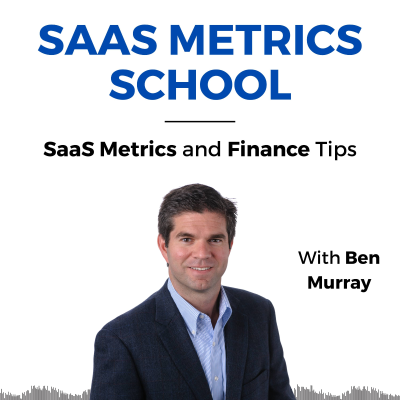

SaaS Metrics School

Podcast by Ben Murray

Limited Offer

3 months for 9,00 kr.

Then 99,00 kr. / monthCancel anytime.

More than 1 million listeners

You’ll love Podimo and you’re not alone

Rated 4.7 in the App Store

About SaaS Metrics School

Ben Murray brings you actionable SaaS metrics lessons that he has learned through years of being in the SaaS CFO trenches. Whether you are new to SaaS or a SaaS veteran, learn the latest SaaS metrics, finance, and accounting tactics that drive financial transparency and improved decision-making. Ben’s SaaS metrics blog consistently rates a 70+ NPS, and his templates have been downloaded over 100,000 times. There is always something to learn about SaaS metrics.

All episodes

295 episodesIn episode #295 of SaaS Metrics School, Ben Murray breaks down how to benchmark your CAC Payback Period accurately—and why generic social media posts can lead you astray. Too many founders rely on simplified benchmark numbers, such as “12 months or less is good,” without understanding the nuances behind the data. Ben explains why ACV segmentation is critical, how top-quartile companies perform across different contract sizes, and where you can obtain customized benchmarks for your SaaS business. Key topics include: * Why aggregate CAC Payback benchmarks are dangerous to follow blindly * How CAC Payback performance varies by Annual Contract Value (ACV) * Top quartile benchmarks from (Ray Rike’s database) * CAC Payback ranges * Why product segmentation matters—don’t combine CAC across SMB and enterprise lines * How to get free, custom benchmarks to evaluate your own performance Remember: You can’t optimize what you don’t benchmark correctly. Get free custom SaaS benchmarks: Benchmarkit.ai [https://www.benchmarkit.ai] Download my CAC Payback Period template: https://www.thesaascfo.com/how-to-calculate-cac-payback-period-with-variable-revenue/ [https://www.thesaascfo.com/how-to-calculate-cac-payback-period-with-variable-revenue/]

In episode #294 of SaaS Metrics School, Ben Murray dives into one of the most important metrics for SaaS operators and investors: CAC Payback Period—with a focus on adapting it for usage-based pricing models. Whether you’re B2B, B2C, or AI-focused, CAC Payback is a must-have metric when you're investing heavily in go-to-market strategies. But how do you accurately calculate it when your business has subscription + usage revenue? Ben walks through: * The standard CAC Payback formula and why it matters * How to define "customer" accurately to calculate CAC * How to adjust the denominator of the formula to include usage-based revenue * How to estimate usage revenue when there’s no clear minimum * Public company trends in reporting ARR in usage-based models * Practical judgment calls that SaaS CFOs must make when incorporating usage data If you're only including subscription ARR in your CAC Payback, but you're generating significant usage revenue—you’re underestimating your efficiency. Learn more: https://www.thesaascfo.com/how-to-calculate-cac-payback-period-with-variable-revenue/ [https://www.thesaascfo.com/how-to-calculate-cac-payback-period-with-variable-revenue/] Coming Up Next: CAC Payback Period Benchmarks—why you can't just trust the averages you see online. Enjoying the show? Leave a 5-star review and stay tuned for more SaaS finance insights.

In episode #293, Ben dives into Contracted Annual Recurring Revenue (CARR)—a once obscure metric that's now becoming a standard in financial dashboards and valuation discussions. Ben explains how CARR differs from ARR, breaks down the formula, and shares how it’s being used in real-world enterprise SaaS settings. He also shares why defining ARR is more complicated than it seems—especially with variable and usage-based revenue models. KEY TOPICS COVERED * What is CARR (Contracted ARR) and how it differs from traditional ARR * Why CARR is becoming more widely used in valuation discussions and financial reporting * The CARR formula * How Ben approaches CARR discussions with CFOs, consultants, and within The SaaS Academy * The evolving complexity of ARR definitions, especially in hybrid subscription/usage models RESOURCES MENTIONED * Blog: How to Define ARR in Subscription & Usage Models [https://thesaascfo.com] * SaaS Academy – Courses & Community [https://thesaascademy.com] SHOUTOUT OFFER Enjoyed the episode? Leave a 5-star review, send Ben a screenshot, and get a shoutout in his newsletter!

Gross profit is a core metric in SaaS—and 80% is the benchmark often thrown around. But is that still realistic in today’s landscape? In episode #292 of SaaS Metric School, Ben Murray walks through real benchmarking data from Ray Rike’s benchmarks at Benchmarkit.ai and explains how gross profit should evolve as your business scales. He also dives into how to set up your SaaS P&L correctly and what to include in COGS vs. OpEx. What You’ll Learn: * What gross profit benchmarks actually look like today * What is our north star GP%? * How gross profit changes as you scale * Common COGS setup mistakes in SaaS businesses * What to do if your gross profit is trending in the wrong direction Benchmarks Mentioned: * Bottom quartile * Median * Top performers Key Insight: Don’t blindly shoot for 80% at every stage. Under $2M ARR? It’s okay to be lower. But once you’re in the $10–20M+ range, that 80% benchmark becomes more important—and achievable. Resources: 👉 Learn how to properly set up your SaaS P&L and COGS categories at: https://TheSaaSAcademy.com [https://TheSaaSAcademy.com] ARR Webinar: https://thesaascfo.webinarninja.com/live-webinars/10693368/register [https://thesaascfo.webinarninja.com/live-webinars/10693368/register] How to Calculate ARR: https://www.thesaascfo.com/how-to-define-and-calculate-arr/ [https://www.thesaascfo.com/how-to-define-and-calculate-arr/]

In episode #291 of SaaS Metrics School, Ben Murray breaks down one of the most important—and often debated—questions in SaaS finance: 💰 How much should we invest in sales and marketing this year? Ben explores how to frame your sales and marketing spend using two key concepts: * Sales & Marketing as a % of Revenue (OpEx Profile) * Cost of ARR (Net New Annual Recurring Revenue Cost) You'll hear current SaaS benchmarks from Ray Rike’s latest data set, which shows how spending evolves from early-stage startups to companies with $100M+ in revenue. Ben explains why high spend isn't bad—as long as there's ROI—and how to use GTM efficiency metrics to stress-test your budget and forecasts. Key Topics Covered: * Sales & marketing spend benchmarks by revenue tier * Understanding your OPEX profile: R&D, S&M, and G&A as % of revenue * Why spend ratios alone don’t tell the full story * How to use the Cost of ARR to validate GTM efficiency * Why growing is NOT scaling, and why that matters for every SaaS operator * The two-metric combo every SaaS CFO should use 🎯 Takeaway: Don’t fly blind. Use these benchmarks and efficiency metrics to create informed, ROI-driven sales and marketing budgets. 📬 Join the Community: https://www.thesaasacademy.com/offers/dzSx6W32 [https://www.thesaasacademy.com/offers/dzSx6W32] Stay updated on new SaaS finance episodes, templates, benchmarks, and industry events by joining Ben’s newsletter: https://mailchi.mp/df1db6bf8bca/the-saas-cfo-sign-up-landing-page [https://mailchi.mp/df1db6bf8bca/the-saas-cfo-sign-up-landing-page] ⭐ Enjoying the show? Leave a 5-star review and help spread the word to more SaaS founders, CFOs, and GTM leaders.

Rated 4.7 in the App Store

Limited Offer

3 months for 9,00 kr.

Then 99,00 kr. / monthCancel anytime.

Exclusive podcasts

Ad free

Non-Podimo podcasts

Audiobooks

20 hours / month