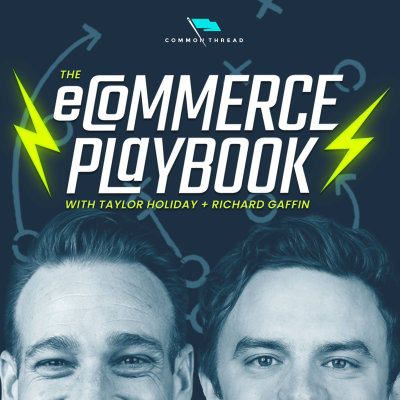

Ecommerce Playbook: Numbers, Struggles & Growth

Podcast von Common Thread Collective

Nimm diesen Podcast mit

Mehr als 1 Million Hörer*innen

Du wirst Podimo lieben und damit bist du nicht allein

Mit 4,7 Sternen im App Store bewertet

Alle Folgen

505 FolgenIn this episode of The Ecommerce Playbook Podcast, Richard Gaffin and Taylor Holiday unpack why forecasting isn’t just about models—it’s about execution. They explore how the best brands combine data, marketing calendars, and disciplined ownership to create forecasts that actually hold up in the real world. Drawing from billions in client data, Taylor explains why finance-driven forecasts often fall short—and how integrating qualitative planning and real-time execution makes all the difference. Together, they lay out the framework that separates accurate, actionable forecasts from guesswork. You’ll learn: • Why finance-only forecasting fails in eCommerce • The three-part framework for accurate forecasting (Quantitative, Qualitative, Execution) • How to tie marketing calendars directly to financial models • Tactical steps to make your forecasts more reliable before Q4 Show Notes: Ready to start texting smarter? Visit https://www.postscript.io [https://www.postscript.io] Explore the Prophit System: https://www.prophitsystem.com [https://www.prophitsystem.com] The Ecommerce Playbook mailbag is open — email us at podcast@commonthreadco.com to ask us any questions you might have about the world of ecomm

In this episode of The Ecommerce Playbook Podcast, Richard Gaffin and Taylor Holiday break down why so many e-commerce leaders rely on guesswork and ambition instead of reality—and how forecasting models like Spend & aMER can change that.Taylor compares these models to a DEXA scan: a clear, data-driven look at your business health. Together, they explain how accurate forecasting systems help you diagnose overspending or underspending, anticipate seasonal changes, and build a roadmap to profitable growth.You’ll learn: - Why most e-commerce budgets are based on wishful thinking - How Spend & aMER models anchor you in reality - The key forecasting tools (Spend, Retention, Event Effect) every brand needs - How to prepare smarter for Q4 and beyondShow Notes:- Ready to start texting smarter? Visit https://www.postscript.io- Explore the Prophit System: https://www.prophitsystem.comThe Ecommerce Playbook mailbag is open — email us at podcast@commonthreadco.com to ask us any questions you might have about the world of ecomm

In this week’s episode of The DTC Hotline, Richard Gaffin is joined once again by Tony “The Chopper” Chopp (VP of Paid Media) and Luke “The Weatherman” Austin (VP of eCommerce Strategy) to take real questions from eComm operators and Admission members—no fluff, just clear, hard-earned answers. They tackle: • What to do when “nothing works” on Meta (and why that diagnosis is often wrong) • How to spot the real business problem hiding behind poor ad performance • Why TikTok creative might crush while Meta flops—and how to close the gap • When to expand into secondary channels like Pinterest or Snapchat (and when not to) • The truth about CPMs—and why chasing lower costs can lead you astray • How to pitch cost caps to your boss so they actually say yes • Why profitable scaling means solving business problems, not just account problems This is where your DTC questions get answered in real time. Call or text us: 866-DTC-2263 Interested in Admission? Learn more at https://www.youradmission.co/ Email: podcast@commonthreadco.com Explore the Prophit System: https://prophitsystem.com

In this episode of the E-Commerce Playbook Podcast, Richard Gaffin is joined by Luke Austin (VP of E-Commerce Strategy at CTC) and Steve Rekuc (Director of Data) to unpack one of CTC’s most powerful forecasting tools: the Spend & aMER Model. This model reveals whether your brand is overspending past the point of profitability—or underspending and leaving growth on the table. By layering in 40+ predictive models, seasonality, and LTV impacts, it provides the clearest roadmap to profitable growth we’ve ever built. You’ll learn: - Why most 8–9 figure brands are shocked when they see their true efficiency curve - How to quantify the real tradeoff between cutting spend and growing top-line revenue - The difference between optimizing for contribution margin today vs. maximizing lifetime margin tomorrow - Why “spending power” is unique to every brand—and how to know yours Get your FREE mystery shopping report from Stord—compare your CX against two competitors: https://stord.link/mystery Explore the Prophit System: https://prophitsystem.com Have a question for the podcast? Email us at podcast@commonthreadco.com

Get an exclusive look behind the curtain with our VP of Strategy, Luke, as he breaks down how CTC is transforming profit-driven growth through clarity, measurement, and scalable systems. Discover how our incrementality tool, daily forecasting workflows, and creative growth frameworks come together in the “prism”—our metaphor for the integrated decision-making engine that fuels brand success.In This Episode, You’ll Learn:- How geo‑based incrementality tests are lowering ad spend risk and increasing clarity- Why Meta, Google Brand, and Google Non‑Brand all perform differently—and how we prioritize ad dollars accordingly- How we’ve scaled effective channels like YouTube, TikTok, Snapchat, and Pinterest—thanks to high-confidence data and targeted ad credits- The three core “Units of Growth” we use to influence profitable expansionShow Notes:Ready to solve your influencer strategy? Book Your Strategy Demo at getsaral.comExplore the PROPHIT System: prophitsystem.comThe Ecommerce Playbook mailbag is open — email us at podcast@commonthreadco.com to ask us any questions you might have about the world of ecomm